How Offshore Business Formation can Save You Time, Stress, and Money.

Table of ContentsThe Definitive Guide for Offshore Business FormationLittle Known Facts About Offshore Business Formation.A Biased View of Offshore Business FormationThe Best Guide To Offshore Business FormationOffshore Business Formation - An OverviewThe Basic Principles Of Offshore Business Formation

Typically speaking, the Cons will certainly vary in a case-by-case scenario. The country where the company is signed up will certainly enforce corporate income tax on its around the world revenue. Additionally, the company will be called for to report its worldwide income on its home nation's tax obligation return. The process of establishing an offshore company is more complicated than establishing a routine company.Establishing up an offshore business does not offer any kind of savings given that you still pay tax on your globally income. If you intend to reduce your worldwide tax obligation concern, you need to think about developing multiple business rather than one offshore entity. When you relocate cash out of an offshore area, you will be liable for that earnings in your house nation.

Offshore Business Formation Fundamentals Explained

The trade-off is that offshore companies sustain costs, prices, and also various other cons. Nonetheless, if you intend to include offshore, after that you need to know about the benefits and drawbacks of including offshore. Every location and also territory is various, and also it's difficult to really recognize truth effectiveness of an overseas business for your company.

If you have an interest in weighing Hong Kong as an alternative, call us to learn more and one of our specialists will stroll you with Hong Kong as an offshore consolidation option (offshore business formation).

Discover the advantages and disadvantages of establishing an offshore company, including privacy and minimized tax obligation obligation, and find out exactly how to register, develop, or include your service outside of your nation of home. In this short article: Offshore firms are businesses signed up, developed, or incorporated beyond the country of house.

The 4-Minute Rule for Offshore Business Formation

If a legal challenger is seeking lawful activity versus you, it typically entails a property search. This ensures there is money for repayments in case of an adverse judgment versus you. Creating overseas firms and also having actually properties held by the abroad firm suggest there is no more a link with your name.

The legal responsibilities in the running of the overseas entity have actually likewise been simplified. Due to the absence of public signs up, confirming ownership of a firm registered offshore can be hard.

Among the primary disadvantages remains in the area of compensation as well as circulation of the possessions and income of the overseas company. As soon as monies reach the resident country, they undergo tax. This can negate the benefits of the first tax-free environment. Dividend earnings obtained by a Belgian holding business from a firm based somewhere else (where income from foreign resources is not exhausted) will certainly pay corporate revenue tax obligation at the typical Belgian price.

Little Known Facts About Offshore Business Formation.

In Spain, keeping tax of 21% is payable on rate of interest as well as returns payments, whether domestic or to non-treaty countries. However, where dividends are paid to a company that has share capital that has been held during the prior year equal to or above 5% withholding tax does not apply. This indicates that tax obligation is subtracted prior to cash can be remitted or transferred to an offshore company.

The major drive of the regulation is in compeling such business to show beyond a sensible uncertainty that their hidden activities are really performed in their corresponding overseas center as well as that these are undoubtedly normal business tasks. There are large tax threats with providing non-Swiss corporations from read this article exterior of Switzerland.

A more factor to consider is that of reputational danger - offshore business formation.

Little Known Questions About Offshore Business Formation.

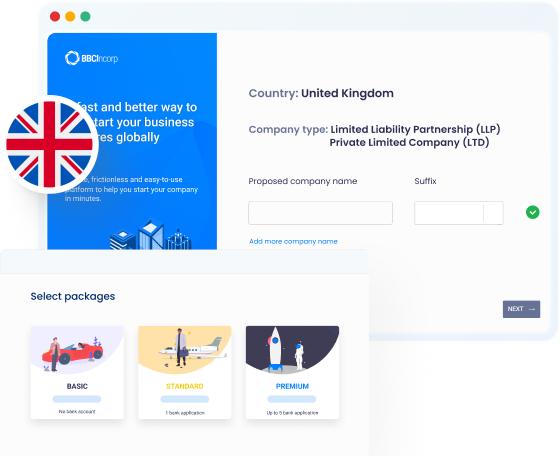

The offshore company enrollment process need to be undertaken in complete guidance of a check out here business like us. The demand of opting for overseas firm enrollment procedure is needed prior to setting up a company. As it is called for to fulfill all the conditions after that one have to refer to an appropriate organization.

Make the most of no taxes, accountancy and also auditing, as well as a completely clear, reduced financial investment endeavor. When choosing a treatment that calls for proper attention while the satisfaction of guidelines and also policies after that it is necessary to follow certain steps like the services given in Offshore Company Formation. To learn more, please full our and a representative will certainly be in contact in due course.

India, China, the Philippines, Poland, Hungary, Ukraine, Brazil, Argentina, Egypt, as well as South Africa are a few of the finest nations for overseas development.

Getting The Offshore Business Formation To Work

There are many reasons entrepreneurs might want setting up an overseas business: Tax benefits, low conformity expenses, an encouraging financial atmosphere, and brand-new trade chances are some of one of the most frequently mentioned factors for have a peek at this website doing so. Right here we take a look at what entrepreneurs require to do if they wish to establish up a Hong Kong offshore firm (offshore business formation).

This is because: There is no demand for the firm to have Hong Kong resident directors (an usual demand in other nations) as Hong Kong embraces a plan that favors overseas companies established up by foreign financiers. offshore business formation. There is no requirement for the business to have Hong Kong resident investors either (a common demand elsewhere) foreign business owners do not need to partner with a regional resident to process a Hong Kong business setup.